Dogecoin. A meme turned cryptocurrency, a digital asset that has captured the imagination of millions. What began as a lighthearted joke has evolved into a thriving community and a legitimate, albeit volatile, player in the cryptocurrency landscape. But how do you actually *get* Dogecoin? While buying it on an exchange is the most common method, mining remains a viable option, especially for those seeking a more hands-on approach. This delves into the world of Dogecoin mining hardware, exploring the options available and how to snag the best deals in a market that’s constantly shifting.

The journey begins with understanding that Dogecoin mining is intertwined with Litecoin. Both currencies utilize the Scrypt algorithm, meaning you can mine them simultaneously through a process called merged mining. This dramatically increases efficiency and profitability for Dogecoin miners. Forget about using your CPU or even GPU; those days are long gone. To seriously mine Dogecoin, you need dedicated hardware: Application-Specific Integrated Circuits, or ASICs.

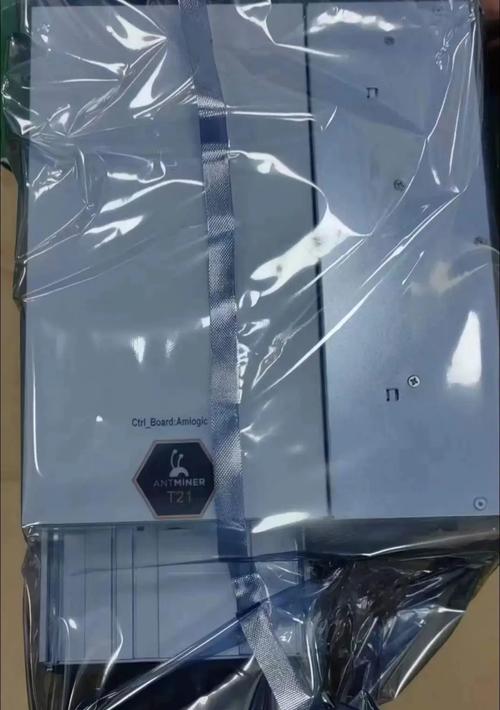

ASICs are essentially purpose-built machines designed solely for mining specific cryptocurrencies. They offer significantly higher hash rates (the speed at which they can solve cryptographic puzzles) compared to CPUs or GPUs, translating to a greater chance of finding blocks and earning rewards. The Antminer L7 and the older Antminer L3+ are two prominent examples of ASICs commonly used for Dogecoin and Litecoin mining. Their power consumption and hash rate are crucial factors to consider.

But procuring these powerful machines isn’t as simple as ordering from Amazon. The market for mining hardware is dynamic, influenced by factors such as cryptocurrency prices, ASIC manufacturer availability, and global supply chain disruptions. Prices can fluctuate wildly, making it imperative to research thoroughly and time your purchase strategically. Consider exploring second-hand markets, but exercise caution and verify the condition and performance of the hardware before committing.

Speaking of profitability, it’s not just about acquiring the hardware; it’s about the *total cost of ownership*. This includes the initial purchase price, electricity consumption (a significant factor!), cooling costs, and potential maintenance or repair expenses. Before investing in any mining rig, use online calculators to estimate your potential earnings based on current Dogecoin prices, network difficulty, and your hardware’s hash rate and power consumption. Always factor in a buffer for price volatility and unexpected expenses.

Another crucial decision is whether to mine solo or join a mining pool. Solo mining means competing directly with other miners for block rewards, which can be a long and potentially fruitless endeavor. Mining pools, on the other hand, combine the hashing power of numerous miners, increasing the chances of finding blocks and distributing the rewards proportionally. While you’ll receive smaller payouts, the consistency and predictability of income are often preferable, especially for beginners.

Furthermore, contemplate the environment in which your mining rig will operate. ASICs generate considerable heat and noise, requiring adequate cooling and ventilation. A dedicated space with proper temperature control is essential to prevent overheating and maintain optimal performance. If you lack the necessary infrastructure, consider mining hosting services. These companies provide the facilities, power, cooling, and security needed to house and operate your mining hardware, allowing you to focus on managing your mining operations remotely.

The landscape of cryptocurrencies is constantly evolving. New mining hardware emerges, algorithms change, and market sentiment shifts. Staying informed about the latest trends and developments is crucial for success in the Dogecoin mining realm. Monitor industry news, participate in online forums, and connect with other miners to learn from their experiences and adapt to the changing dynamics of the market.

While the allure of quick riches may tempt some, Dogecoin mining is a serious undertaking that requires dedication, research, and a realistic understanding of the risks involved. By carefully evaluating your options, conducting thorough due diligence, and managing your costs effectively, you can increase your chances of securing the best deals on Dogecoin mining hardware and potentially carving out a profitable niche in this dynamic digital world. Remember, the best deals are not just about price; they’re about value, reliability, and long-term sustainability.

Ultimately, the decision to mine Dogecoin, or any cryptocurrency, rests on your individual circumstances and risk tolerance. It’s not a guaranteed path to wealth, but for those who are passionate about the technology and willing to put in the effort, it can be a rewarding and engaging experience. So, do your research, weigh your options, and may the odds be ever in your favor… or, at least, may the difficulty be low enough to turn a decent profit!

Leave a Reply to GlowGoblin Cancel reply