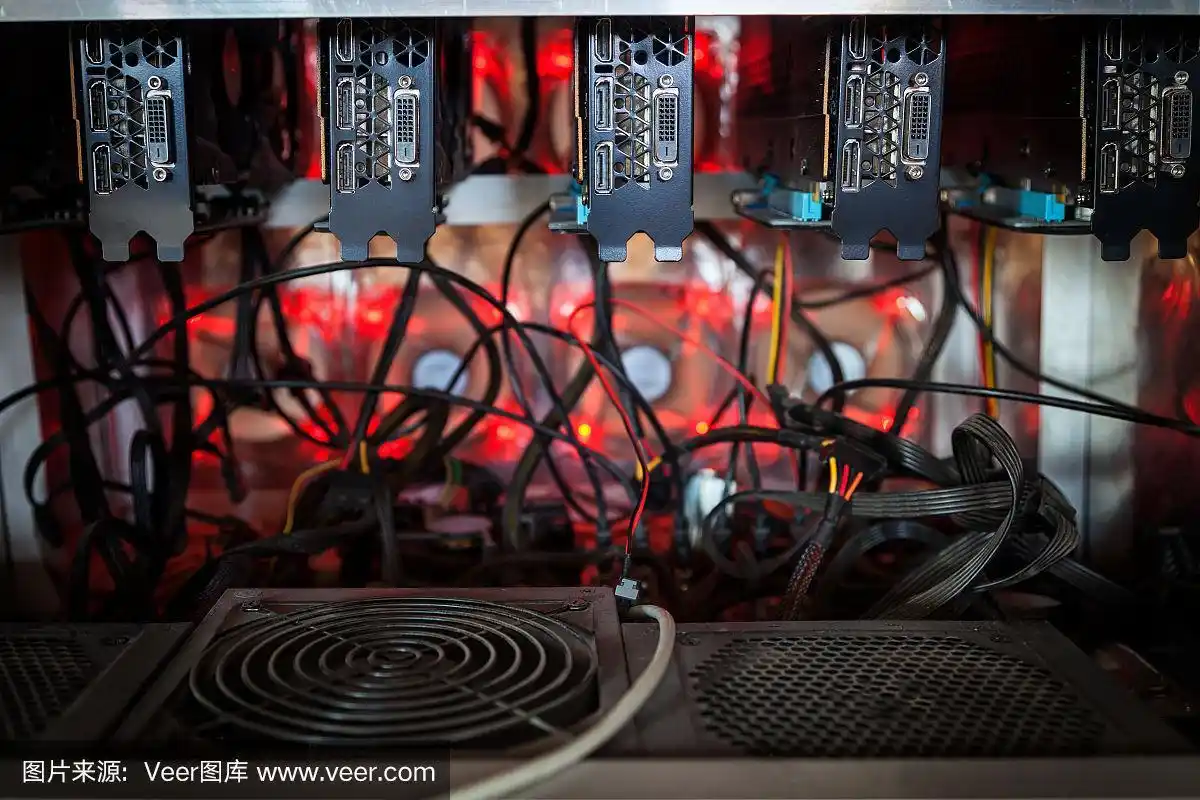

In the fast-paced world of cryptocurrency mining, acquiring high-performance mining machines can be a significant upfront investment. This is where mining machine installment payment plans emerge as a game-changer, providing miners with flexible financing options tailored to diverse financial capacities. These plans enable enthusiasts and professional miners alike to embark on or scale their mining journey without the immediate burden of full capital expenditure.

Imagine stepping into the mining arena with the latest ASIC miners or next-gen GPU rigs without emptying your bank account. Installment plans democratize access to this technology, turning what once was a steep financial hill into a climb that many can conquer step by step. Whether you are targeting Bitcoin with its notoriously competitive SHA-256 miners, Ethereum with its ethash-optimized GPUs, or diversifying into altcoins, spreading your payments allows for better cash flow management.

One crucial advantage of choosing installment payment plans is the ability to stay updated with market trends. Mining rigs evolve rapidly; thus, committing your entire budget at once might mean missing out on newer, more efficient models released shortly afterward. Installments spread over months or even years offer an opportunity to invest incrementally, making it feasible to upgrade equipment as technology advances. The result? Enhanced hash rates, improved energy efficiency, and ultimately, higher returns on your mining farm.

Besides hardware acquisition, many companies offering mining machine hosting services embed flexible payment solutions in their packages. For miners unfamiliar with running large-scale infrastructure, hosting providers manage everything—from cooling systems to power supply to maintenance—allowing customers to focus solely on mining profit optimization. Here, installment plans not only apply to buying the rig but sometimes extend to hosting fees, effectively lowering the barrier to entry for fully managed mining solutions.

However, miners considering financing options need to analyze the fine print of installment agreements. Interest rates, payment durations, and penalties for late payments can impact overall profitability. Strategic planning and realistic difficulty and price projections for cryptocurrencies are essential before committing. For example, a rising Bitcoin price might expedite installment repayments, while bearish trends necessitate cautious budgeting.

It’s also worth noting that hosting miners often enjoy economies of scale not available to individual operators. Large mining farms leverage bulk electricity rates and optimized hardware placements to cut overhead, passing benefits down to clients. This can improve margins on monthly installment structures when hosting is combined with flexible financing offers.

For the passionate crypto miner, the decision to adopt installment plans transcends mere financial convenience. It symbolizes a strategic approach to navigating the volatile, competitive mining landscape. By breaking down costs and embracing financing agility, miners can more dynamically adjust their rigs, experiment with multiple algorithms like SHA-256 for Bitcoin or Ethash for Ethereum, and even allocate capital to diversify digital asset portfolios.

In essence, flexible financing in mining machine acquisition and hosting paves the path for innovation, enabling a broader spectrum of miners—from hobbyists to institutional operators—to harness the power of blockchain validation. Thoughtfully structured installment payments don’t just fund machines; they fuel dreams of decentralized wealth creation, technological advancement, and participation in the global crypto economy.

Leave a Reply to Evan Cancel reply